straight life policy term

Compare and Get Instantly Approved Online. A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or.

Straight Life Annuity Definition

A straight life insurance policy offers coverage that lasts a lifetime with premiums that stay the same over the life of the policy.

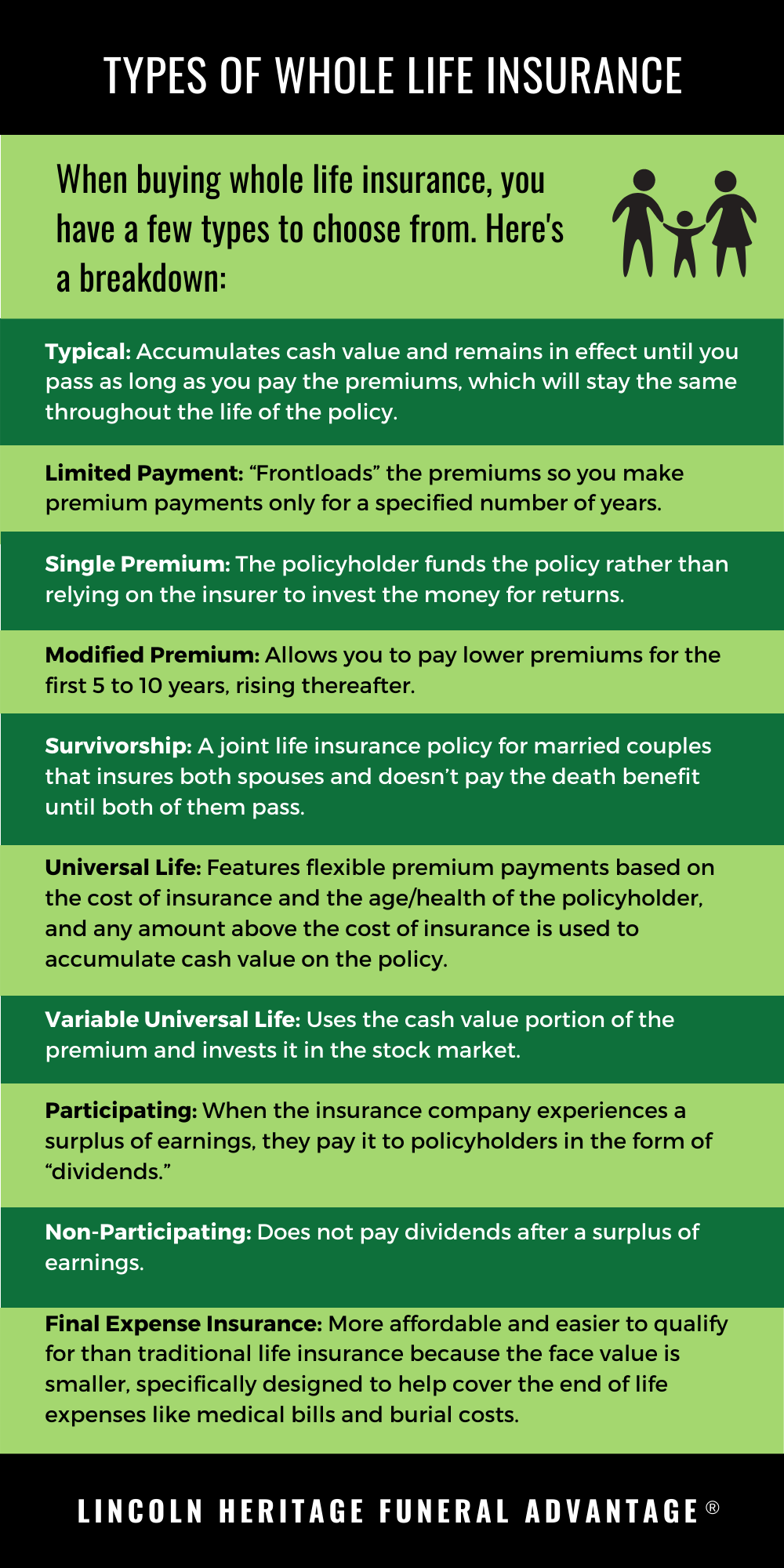

. Straight life policies are often expensive and therefore not recommended for short-term life insurance coverage. Insuranceopedia Explains Whole Life Insurance. Whole life insurance sometimes called straight life or ordinary life is a life insurance policy guaranteed to remain in force for the insureds entire lifetime provided.

A straight life insurance policy offers coverage that lasts a lifetime with premiums that stay the same over the life of the policy. International Risk Management Institute Inc. It is also known as whole life insurance.

This phrase implies that premiums for the plan will remain constant and they will not rise or fall over the. The term straight refers to the whole life insurance policys premium structure. The term straight life insurance is no longer used in the insurance industry but it pops up occasionally when people talk about life insurance.

Life Insurance Provides Peace Of Mind Knowing Youre Protecting People You Love. Learn the benefits of straight life insurance for individuals families and business. Ad SBLI Has Been Protecting Families for Over 110 Years.

A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or. Click to go to the 1. No-med-exam life insurance available.

A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or. Ad Prudential Has The Life Insurance Options To Fit Your Needs. What you need to know is that in todays.

February 27 2022. Straight life insurance is more commonly known. Ad Our Comparison Chart Makes Choosing Simple.

An insured has a variable life policy with a 100000 face amount. Ad A Life Insurance Policy You Can Trust At A Price That Works For You. A straight life insurance policy provides coverage for a lifetime with constant premiums throughout the policys term.

Apply Online in Just Minutes. The face value of the policy is paid to the insured at age 100. A straight life insurance policy offers coverage that lasts a lifetime with premiums that stay the same over the life of the policy.

Straight term insurance policy Term life insurance policy providing a fixed-amount death benefit over a certain number of years. It usually develops cash value by the end of the third policy year. 12222 Merit Drive Suite 1600 Dallas TX 75251-2266 972 960-7693 800 827-4242.

The Most Reliable Term Life Insurance Providers That Have Your Interests At Heart. ROP policies however return some or all of the premium if you outlive the policy. American Amicable offers term whole life and.

For example the average cost of a 20-year 100000 term life insurance. Because whole life insurance offers permanent coverage or coverage during the policyholders entire life the premium is. Straight life insurance is more commonly known.

At one time the cash value exceeded 100000 and was worth 150000. Straight life insurance is. After death however the payments cease and the.

See how a straight life policy compares to term or universal life. A straight life policy has what type of. A straight term insurance policy provides a benefit upon the death of the policyholder but ceases to provide.

Straight Life An annuity or other insurance plan that provides the policyholder with monthly payments for the remainder of hisher life. A life insurance policy that provides coverage only for a certain period of time. It has the lowest annual premium of the three types of.

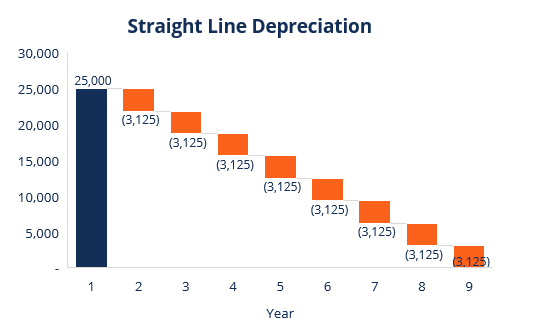

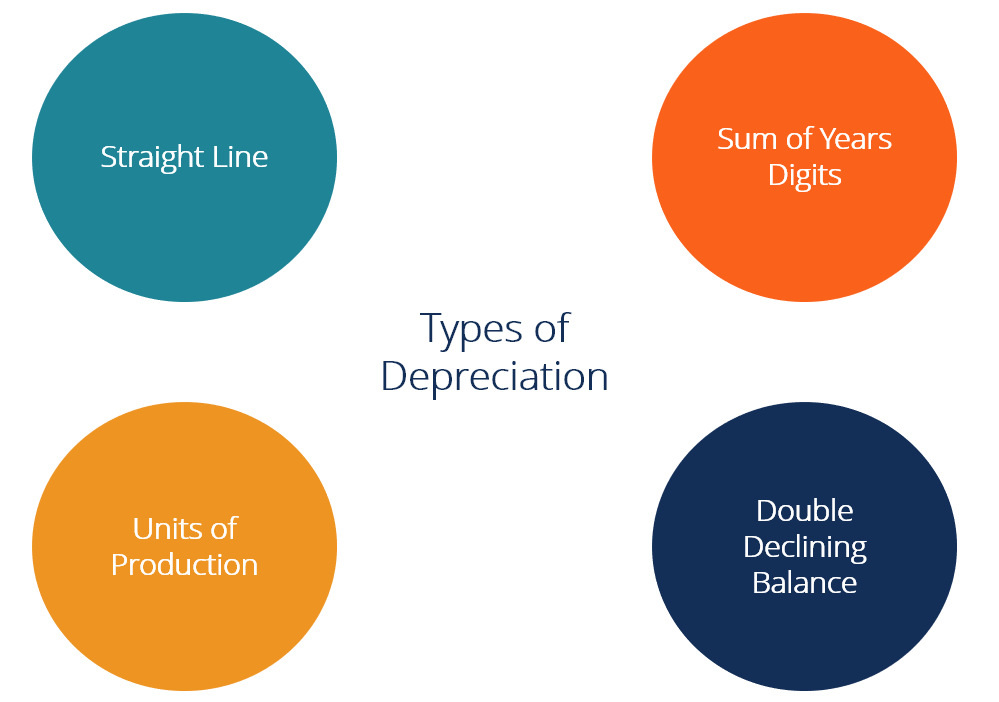

Depreciation Methods 4 Types Of Depreciation You Must Know

Whole Life Insurance Definition

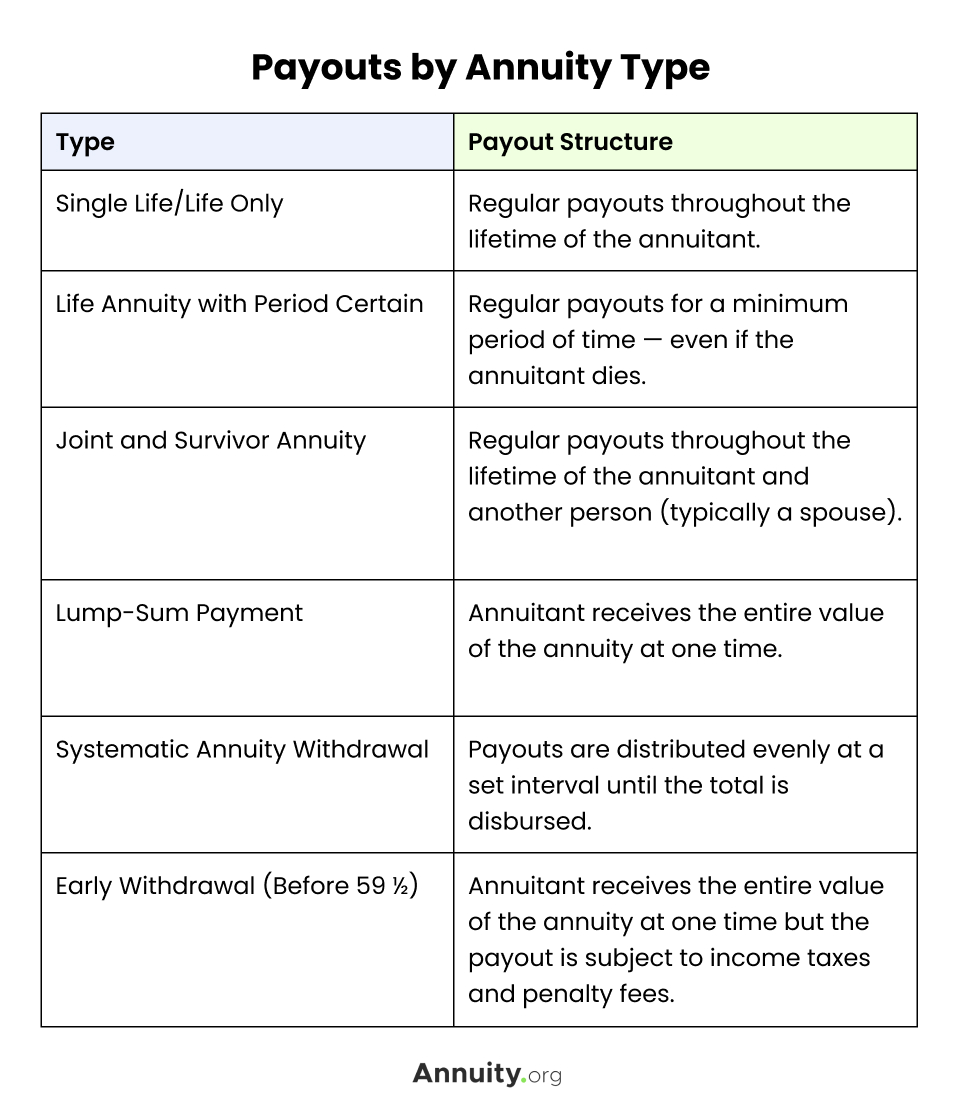

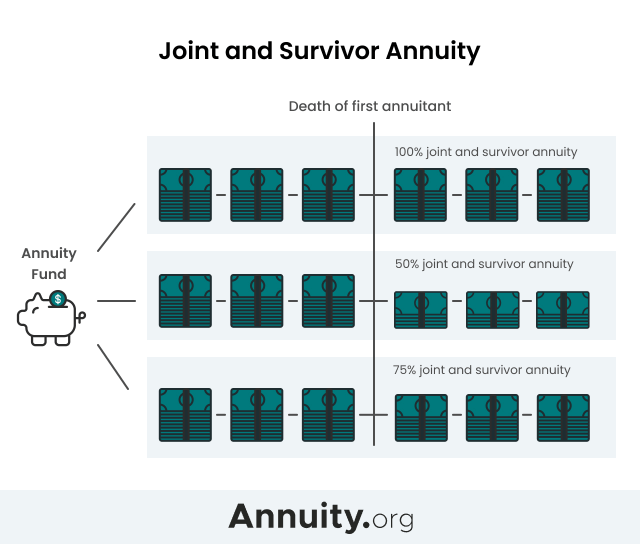

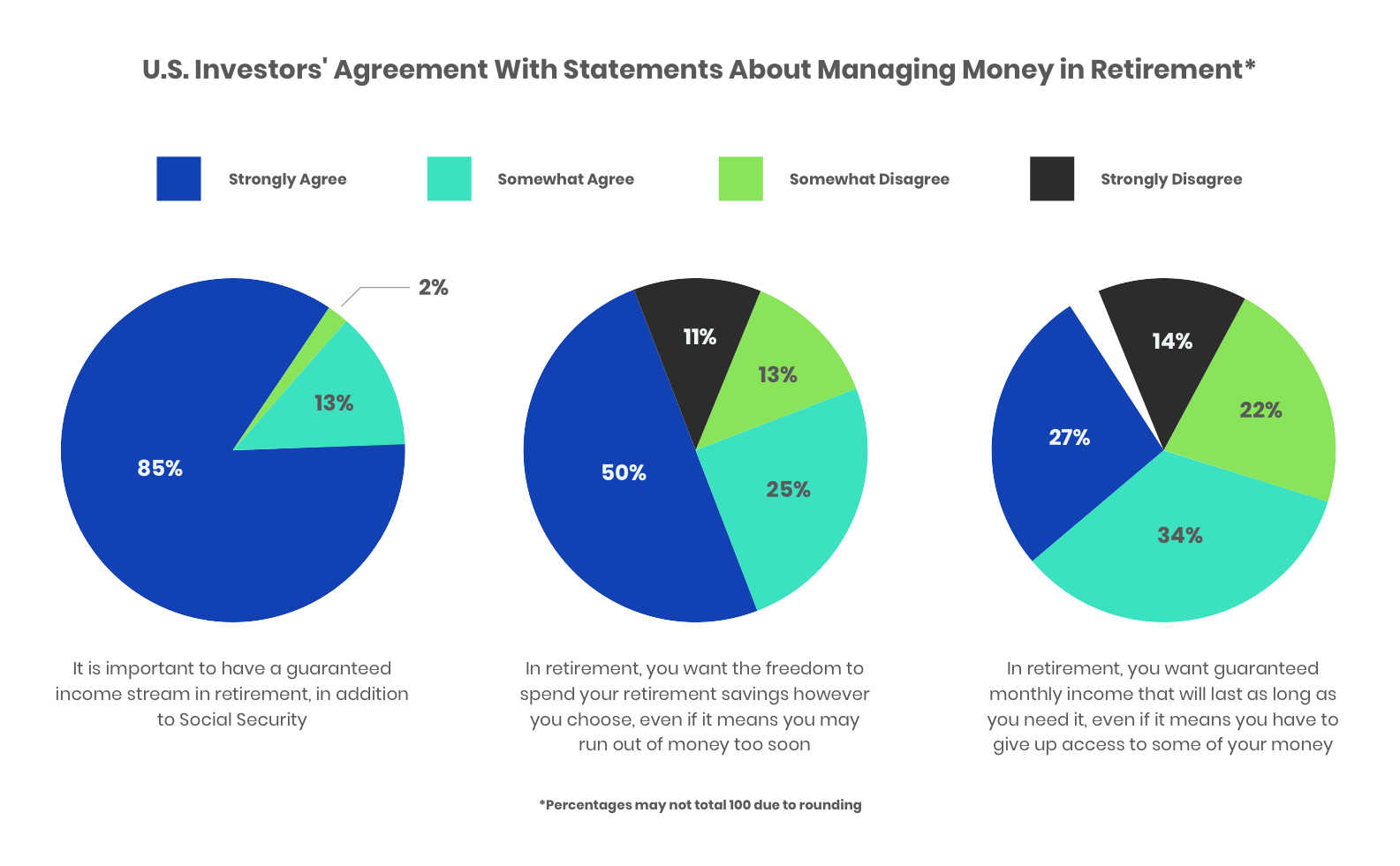

Joint And Survivor Annuity The Benefits And Disadvantages

/stacks-of-coins--a-compass-and-documents-signaling-finances-184104157-eea22b5b70b744318f04c2b6f54a5ef4.jpg)

Straight Life Annuity Definition

Straight Line Depreciation Formula Guide To Calculate Depreciation

Depreciation Methods 4 Types Of Depreciation You Must Know

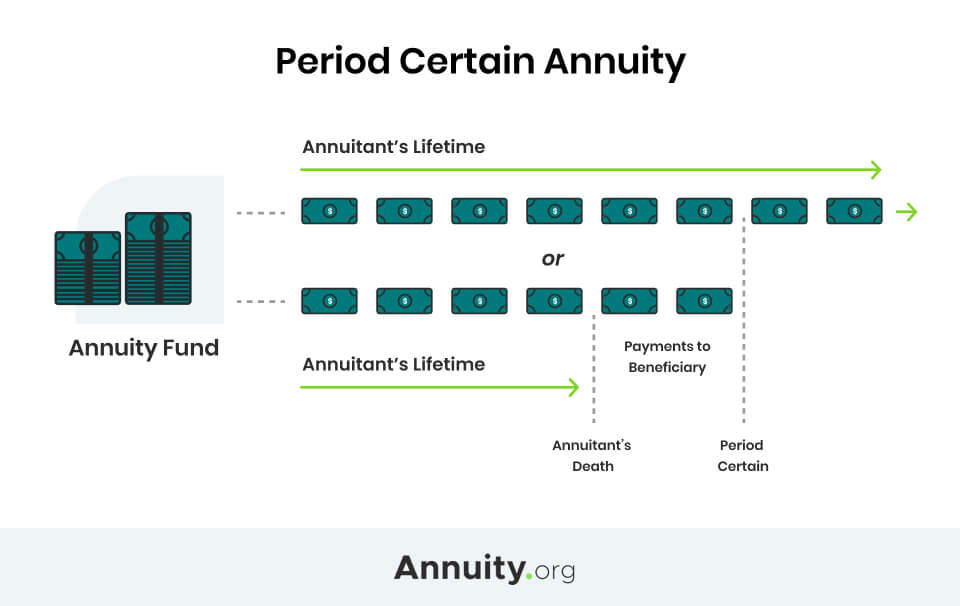

Period Certain Annuity What It Is Benefits And Drawbacks

Straight Line Depreciation Formula Guide To Calculate Depreciation

How Does Life Insurance Work The Process Overview

Annuity Payout Options Immediate Vs Deferred Annuities

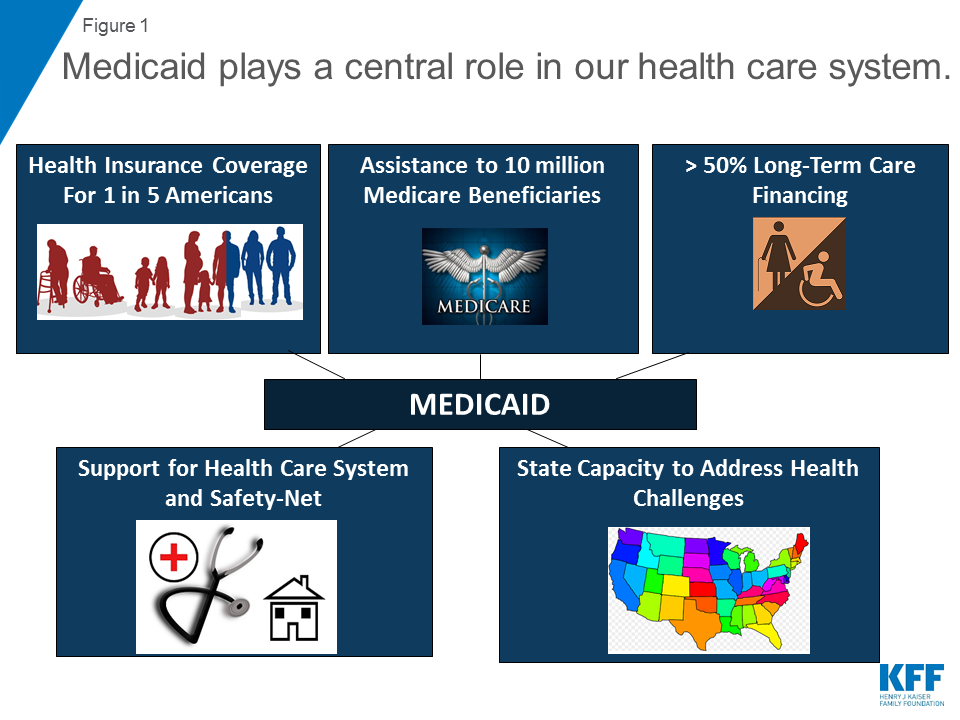

10 Things To Know About Medicaid Setting The Facts Straight Kff

Depreciation Methods 4 Types Of Depreciation You Must Know

What Is Whole Life Insurance Cost Types Faqs

/GettyImages-184985261-257061c6b35546779a16b51ca1e9da8e.jpg)

/What-is-heteronormativity-5191883-FINAL-0c8f5100dbe04694a6fe1fbba052748f.png)

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)